| NXT Capital Senior Loan Fund VII (UL) (the “Fund”) | |

| Summary | The Fund is categorised as an Article 8 financial product for the purposes of SFDR. |

| No Sustainable Investment Objective | This Fund promotes environmental or social characteristics, but does not have as its objective sustainable investment. |

| Environmental or social characteristics promoted by the Portfolio | The Fund will seek to promote the environmental and social characteristics below:

1) tracking, reduction, and disclosure of GHG emissions; 2) labour/employment conditions that do not violate United Nations Global Compact Principles; 3) effective abolition of child labour; 4) efforts to improve health and safety of employees; and 5) products and/or services that protect the public’s health, benefits society, or promotes adherence to business ethics & compliance.

|

| Investment Strategy | The Fund will seek to generate attractive risk adjusted returns by acquiring portions of first lien loans and second lien loans in credit facilities extended to middle market companies (including one or more tranches comprising any of these loans, each of which tranches could have differing characteristics such as lien priority, repayment terms or interest rates), in each case regardless of whether term loans, delayed draw term loans or revolving credit facilities (all such loans collectively referred to as “Loans” and individually as a “Loan”).

Each obligor underlying a Loan is generally expected to be organized in, or have significant business operations or property in, or derive significant revenue from, the United States or Canada. NXT Capital Investment Advisers, LLC (the “Investment Manager“) will assess good governance practices of the investee companies, including assessment of sound management structures, employee relations, remuneration of staff and tax compliance based on available information. Through due diligence processes, the manager will utilize the Sustainability Risk Scorecard to document risks pertaining to governance practices. The Investment Manager’s typical due diligence processes include examination of and comfort with the borrower’s general governance practices, corporate policies and corporate culture, including human capital management, shareholder and stakeholder engagement, demonstration of a sound management structure, a history of positive employee relations and retention, appropriate cybersecurity, and a history of compliance with tax policy, laws and industry-specific regulations, among other governance factors. The Investment Manager may also utilize third-party firms to conduct governance-related diligence, including quality of earnings analyses, special purpose accounting reviews, background checks on senior company management, environmental reviews, industry reviews, legal diligence reports, know-your-customer database checks both pre-close and as monitored on an ongoing basis, technology reviews and business plan reviews. |

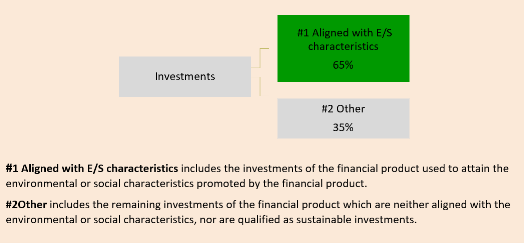

| Proportion of Investments

|

The Fund will promote environmental and/or social characteristics, but does not have sustainable investments as its objective. The Fund will allocate at least 65% of its invested capital in portfolio companies which promote environmental and / or social characteristics (Tier 1 and Tier 2 as noted above). No more than 35% of the Fund’s invested capital will be allocated to companies that are not aligned with the environmental and/or social characteristics promoted by the Fund and are not sustainable investments, and which fall into the “Other” portion of the Fund. Each underlying investment’s Tier designation will be determined upon underwriting and closing into the Fund. The portfolio construction parameters will abide by the initial underwriting Tier, regardless of any change in the Tier post-close. The Fund will not use derivatives to promote environmental and/or social characteristics.

|

| Monitoring of environmental or social characteristics | The Investment Manager will seek to collect data directly from borrowers through direct engagement with the borrower on a minimum annual basis using a questionnaire. The questionnaire will include questions used during the underwriting process to assess the borrower’s alignment with the Fund’s objective, including but not limited to certain PAIs and emissions data points. Data will be collected and managed through a third party sustainability software platform. Where emissions data is missing, the Investment Manager will use estimates from its third party sustainability software platform and seek to encourage engagement from borrowers to assess the reasonableness of such estimates.. |

| Methodologies for environmental or social characteristics | Exclusions

The Fund will not invest in companies that derive a material portion of revenues (greater than 10% at the time of the initial assessment) from the industries listed below : 1) Thermal Coal: Includes coal extraction, coal-fired power generation; 2) Adult Entertainment: Includes pornography, adult material, prostitution; 3) Firearms: Includes guns and ammunition sellers and manufacturers; 4) Controversial Weapons: Includes manufacturers of military-style firearms made available for civilian use, weapons of mass destruction and/or weapons such as cluster bombs, anti-personnel mines, chemical or biological weapons; 5) Tobacco: Includes tobacco and tobacco-related products; 6) Opioids: Includes the production of opioids; 7) Predatory or Payday Lending: Includes payday lenders; and, 8) Unregulated or Unlicensed Gaming Entities. Sustainability Risk Scorecard The Investment Manager will screen all potential investments for the Fund through the firm’s Sustainability Risk Scorecard which is generally aligned with the requirements, restrictions, or objectives set forth in the United Nations Global Compact and the United Nations Principles for Responsible Investment. The assessment is derived from information gathered from public databases, supplemented by proactive engagement and thorough due diligence practices, which shall provide the Investment Manager with a comprehensive understanding of each potential investment’s sustainability factors, including environmental, financial, governance, operational, reputational, and/or social factors. This allows the Investment Manager to identify any such risk factors impacting the environmental and / or social characteristics promoted by the Fund, and to ultimately determine if the potential investment is suitable for the Fund. Any company that the Investment Manager determines to have high risk factors, or is deemed to negatively impact alignment with the Fund’s promotion of environmental or social characteristics, resulting in a Sustainability Risk score below 3 out of 5, shall be ineligible for investment from the Fund. Post-close, deal teams will update the Sustainability Risk Scorecard on at least an annual basis. Alignment Addendum The Investment Manager will screen all potential investments’ alignment with the promotion of environmental or social characteristics through the Alignment Addendum utilizing information collected during the underwriting process. The Alignment Addendum consists of a minimum 13 diligence questions, and also considers the output of the Sustainability Risk Scorecard. A proprietary scoring methodology is used to determine a tier designation at origination under the Alignment Addendum (Tiers 1-4) and confirm eligibility into the Fund. The Fund will allocate at least 65% of its invested capital in portfolio companies rated as a Tier 1 or Tier 2 investments, which therefore are deemed by the Investment Manager to align to the environmental and / or social characteristics promoted by the Fund. No more than 35% of the Fund’s invested capital will be allocated to Tier 3 investments, defined as portfolio companies that are not aligned with the environmental and/or social characteristics promoted by the Fund, however, do have basic policies in place . Exclusions from the Fund will include Tier 4 investments and investments which rate below Risk Level 3 on the Sustainability Risk Scorecard as described above. Post-close, deal teams will update the Alignment Addendum on a minimum annual basis through updated diligence work and proactive engagement with the borrowers’ management teams.

|

| Data sources and processing | The Investment Manager will collect data directly from borrowers through direct engagement with the borrower on a minimum annual basis using a questionnaire derived from the Alignment Addendum. The questionnaire will include questions used during the underwriting process to assess the borrower’s alignment with the Fund’s objective, including but not limited to certain PAIs and emissions data points. Where emissions data is missing, the Investment Manager will use estimates from a third party sustainability software platform which will have active oversight by ORIX USA’s Sustainability group. Data will be collected and managed through a third party sustainability software platform which will track information in a consistent manner. Additionally, the Investment Manager will also receive the support from ORIX USA’s Sustainability group to review collected data prior to external reporting. |

| Limitations to methodologies and data | The availability and quality of data will vary across borrowers due to the maturity of lower middle market companies. The PAIs that are taken into consideration are subject to there being adequate, reliable and verifiable data coverage for such indicators, and may evolve with improving data quality and availability. Where such data is not available the relevant PAI will not be considered until such time as the data becomes available. The Investment Manager will keep the list of PAIs they consider under active review, as and when data availability and quality improves. |

| Due Diligence | Through due diligence processes, the Investment Manager will utilize the Sustainability Risk Scorecard to document risks pertaining to governance practices and the Alignment Addendum to document a company’s alignment with the Fund’s objectives. Deal teams will include the outputs of both tools in the investment memo. Additionally, the assessments will be relied upon when conducting ongoing portfolio monitoring.The Sustainability Risk Scorecard and Alignment Addendums will be updated on a minimum annual basis. |

| Engagement Policies | As part of its engagement process, the Investment Manager will seek to collect data from its borrowers on an annual basis. The Investment Manager will engage with its third party sustainability software platform and adviser to calculate emissions estimates (where needed) and benchmark results with a peer set. Deal teams will engage with borrowers to present these estimates and benchmark results and offer the opportunity for borrowers to further refine its emissions estimates through the provision of additional data points. For questions pertaining to policies, the deal teams will continue to engage with borrowers on existence and/or completeness of these policies. For any newly reported incidents, violations, deal teams will engage with borrowers to understand circumstances leading to these incidents/violations and discuss prevention strategies.

In the case where deal team engagement fails to address material concerns, deal teams may consult with ORIX USA’s Sustainability Advisory Group who may recommend considering alternative risk reduction strategies, to the extent available and reasonable, including but not limited to, reducing the position or divesting to better align with the applicable investment mandate’s requirements while staying true to ORIX USA Group’s fiduciary responsibility to its Clients’ interests. The implementation of such decisions would be approved by the Investment Manager’s investment committee.

|

| Designated Reference Benchmark | N/A |